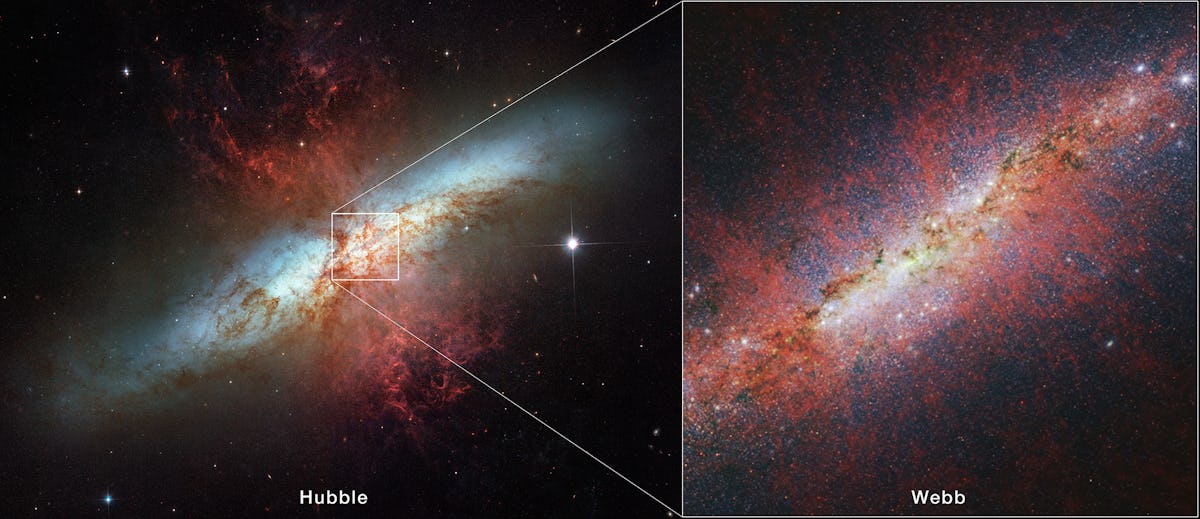

"The James Webb Space Telescope, or JWST for short, is one of the most advanced telescopes ever built......... It was launched into space on Dec. 25, 2021, and within a month arrived at its final destination: 930,000 miles away from Earth. Its location in space allows it a relatively unobstructed view of the universe".... More at The Conversation➜

Public Posts Edmonds, WA Edmonds, WA (zoom)

"For the Kansas City Chiefs brass, it must have seemed like the perfect time to ask local voters to cough up some money for stadium renovations.....The team was riding high from a big Super Bowl win in February 2024, its third NFL championship in the past five years." More at The Conversation ➜

..." The relatively small size of the Moon and its shadow make eclipses truly once-in-a-lifetime opportunities. On average, total solar eclipses are visible somewhere on Earth once every few years. But from any one location on Earth, it is roughly 375 years between solar eclipses." .... More at The Conversation ➜

"Saudi Arabia has been chosen as the chair of the UN commission that is supposed to promote gender equality and empower women around the world, after an unopposed bid for leadership condemned by human rights groups because of the kingdom’s “abysmal” record on women’s rights." Read More at The Guardian ➜

..."Researchers suggest, up to 90% of tattoo inks in the U.S. might be mislabeled. This isn’t just a case of a missing pigment or a minor discrepancy. These inks contained potentially concerning additives that weren’t listed on the packaging. More at The Conversation ➜

"Organized crime is mining sand from rivers and coasts to feed demand worldwide, ruining ecosystems and communities. Can it be stopped? ....... Every year the world uses up to 50 billion metric tons of sand, according to a United Nations Environment Program report. The only natural resource more widely consumed is water. " More at Scientific American ➜

The increase number of challenges targeted 65% more books titles for Censorship over The Previous Year. More at The American Library Association ➜

"Reconnecting children and nature may be the last cause in America that transcends political, religious, racial, and professional barriers; it brings people to the same table who usually do not want to be in the same room. Again and again, I have seen conservatives and liberals, physicians and educators, conservationists and developers, and many others work together for this cause. No one wants to be in the last generation where it’s considered normal for a child to lay under a tree in the woods" More at The MIT Press Reader ➜

"......once melting glaciers shut down the Gulf Stream, we would see extreme climate change within decades, study shows" More at The Conversation ➜

"Dietary supplements are a big business. The industry made almost US$39 billion in revenue in 2022, and has very little regulation and oversight...Supplements are regulated as food instead of drugs, even though they can interact with medications and may be laced with hidden drugs not included on the label....The FDA’s website states that “many dietary supplements contain ingredients that have strong biological effects which may conflict with a medicine you are taking or a medical condition you may have." More at The Conversation ➜

"Chances of getting records from a federal agency drop. An analysis of 37,000 Freedom of Information Act requests submitted to federal agencies through MuckRock.com shows that in 2010, barely more than half of requests yielded the records sought. But by 2022, barely more than 10% of requests met with success". More at The Conversation ➜

Josep Borrell remarks at the United Nations, N.Y:

“But this is a humanitarian crisis, which is not a natural disaster. It’s not a flood. It’s not an earthquake. It’s man-made. And when we look for alternative ways of providing support, by sea or by air, we have to remind that we have to do it because the natural way of providing support, through roads, is being closed, artificially closed, and starvation is being used as a war arm. And when we condemn this happening in Ukraine, we have to use the same words for what’s happening in Gaza.”

"We are now facing a population fighting for their own survival,"

A Spanish ship has left Cyprus for Gaza carrying urgently needed food supplies but the UN says this cannot replace the delivery of aid by land.

.jpg?fit=crop&w=280&h=280&q=93)

.jpg?fit=crop&w=200&h=200&crop=faces)

.png?fit=max&w=1200&h=1200&q=48)

- Copy.jpg?fit=crop&w=280&h=280&q=93)