There is still time to enroll for individual health insurance! Washingtonians have until January 15th to get coverage starting February 1, 2021. The attached Newsletter has information about the health insurance companies, counties they serve, provider networks and tax subsidy/reduced rate info. Click the photo below to go to the Exchange and can create an account. For my assistance, go to Quick Links and "Find a Broker" and type "Suderman" in the last name field and confirm your request. I will then be notified so we can connect. There is no charge to you for this service.

Public Posts Edmonds, WA Edmonds, WA (zoom)

When it comes to health care, President Donald Trump has promised far more than he has delivered. But that doesn’t mean his administration has had no impact on health issues — including the operation of the Affordable Care Act, prescription drug prices and women’s access to reproductive health services............ Continue Reading

Physicians Premier ER charged Dr. Zachary Sussman’s insurance $10,984 for his COVID-19 antibody test even though Sussman worked for the chain and knows the testing materials only cost about $8. Even more surprising: The insurer paid in full.

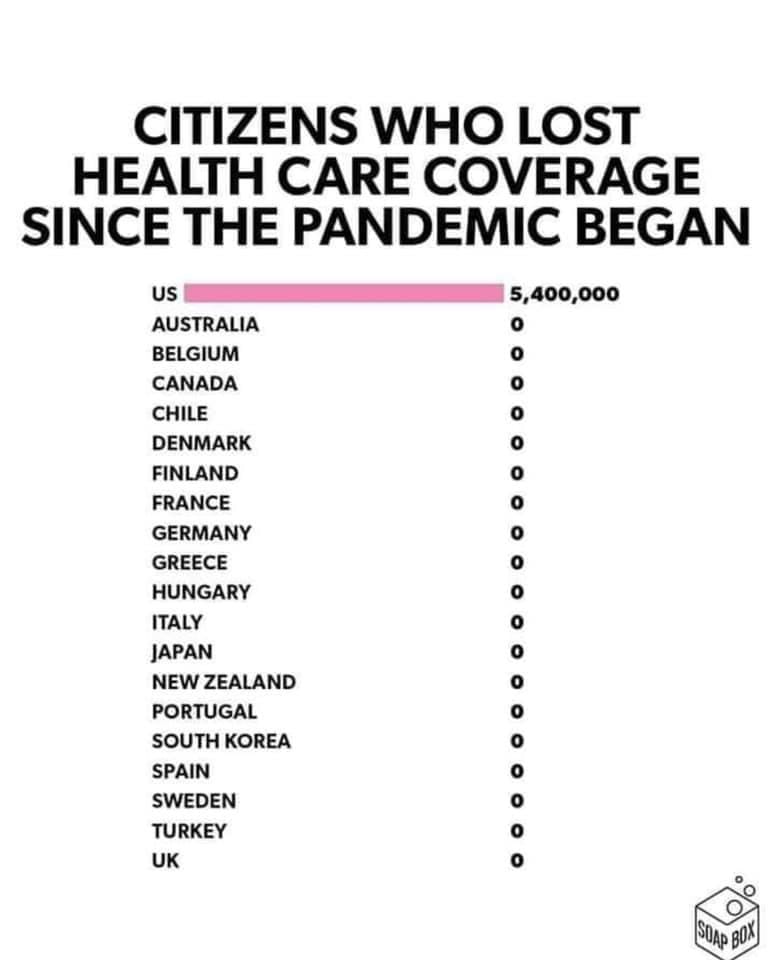

When COVID-19 smacked the United States in March and April, health plans feared medical costs could skyrocket, jacking up premiums drastically in 2021, when millions of the newly unemployed might still be out of work.

But something else happened: Non-COVID care collapsed as hospitals emptied beds and shut down operating rooms to prepare for an expected onslaught of patients sickened by the coronavirus, while fear of contracting it kept people away from ERs, doctors’ offices and outpatient clinics. In many regions of the country, the onslaught did not come, and the billions of dollars lost by hospitals and physicians constituted huge savings for health plans, fattening their bottom lines.

But that doesn’t mean consumers will see lower premiums next year.

Numerous insurers across the country have announced plans to hike rates next year, though some have proposed cuts.

Peter Lee, executive director of Covered California, appeared skeptical about premium reductions in the state’s Affordable Care Act exchange, which is likely to announce 2021 health plan rates next week.

“Would we like zero increases? Absolutely. Would we like them negative? Yeah — but not if that means you’re going to increase premiums in a year by 20%,” Lee said in an interview with California Healthline this week. “We’ve been leaning on them to do what we always lean on them to do, and this is to have the lowest possible rates where you won’t be on a rate roller coaster. We want health plans to price right — not to price artificially low or artificially high.”

Covered California provides coverage for about 1.5 million residents who buy their own insurance.

If the insurance exchanges in other states offer any guidance for Covered California, it is in the direction of moderate premium increases for 2021, though there is wide variation.

A KFF analysis last week of proposed 2021 rates in the exchanges of 10 states and the District of Columbia showed a median increase of 2.4%, with changes ranging from a hike of 31.8% by a health plan in New Mexico to a cut of 12% in Maryland. (Kaiser Health News, which produces California Healthline, is an editorially independent program of KFF.)

Among the roughly one-third of filings that stated how much COVID-19 added to premiums, the median was 2%, with estimates ranging from minus 1.2% at a plan in Maine to 8.6% at one in Michigan.

The proposed premiums for ACA marketplace plans do not affect job-based coverage, but they may indicate how the pandemic is affecting premiums generally.

The consensus among industry experts is that COVID-19 has generated little pressure for rate rises, and health plans should err on the side of moderation. But some fear that many insurers will hold onto the reserves they’ve built up, citing the possibility of widespread vaccinations and concerns that the care forgone in 2020 could rebound with a vengeance next year.

“The tendency of health plans, when they are faced with any degree of uncertainty, is to be very conservative and price for the worst-case scenario,” said Michael Johnson, an industry observer and critic who worked as an executive at Blue Shield of California from 2003 to 2015. “Actuaries are less likely to get fired if the plan prices too high than if the plan prices too low. But I think regulators really need to push back hard on that.”

Lee said all 11 insurers participating in the exchange this year will remain in 2021, and no new ones will be added to the mix, though some of the current carriers will extend their coverage geographically. Ninety percent of consumers who buy their own health insurance get subsidies from the federal government or the state to help pay their premiums.

In January, California became the first state to offer subsidies to middle-income people who make too much money to qualify for federal subsidies. The lion’s share of the state subsidies is earmarked for those who earn between 400% and 600% of the federal poverty level, or $51,040 to $76,560 a year for an individual and $104,800 to $157,200 for a family of four.

The rate proposals expected to be unveiled next week will be subject to scrutiny by state regulators before they are finalized. Sign-ups for the plans start Nov. 1 and run through Jan. 31. This year, the average Covered California rate increase statewide was 0.8%, the lowest since the exchange started providing coverage in 2014.

The benefits reaped by health plans so far in the pandemic can be seen in strong second-quarter earnings and reduced spending on care. UnitedHealth Group, the nation’s largest health insurer, announced earlier this month that its net profit in the April-June quarter nearly doubled from the same period a year earlier. Its medical spending plummeted from 83.1% of premium revenue to 70.2% over that period.

Anthem, the parent company of Blue Cross of California, reported Wednesday that its net profit in the second quarter doubled from the same period in 2019, also on the back of plunging medical expenses.

Anthem said it offered one-month premium credits ranging from 10% to 50% to enrollees in individual, employer and group dental policies — including its Blue Cross plans in California.

UnitedHealth said it has provided $1.5 billion worth of financial support to consumers so far, including premium credits and cost-sharing waivers, and expects to pay out $1 billion in rebates.

But UnitedHealth, which does not participate in Covered California, is seeking a rate increase of 13.8% in the New York exchange. Anthem, which covers about 80,000 people in Covered California, is planning rate hikes of 16.6% in Kentucky and 9.9% in Connecticut.

On the other hand, Kaiser Permanente, which covers more than one-third of Covered California enrollees, plans rate cuts in other states, ranging from 1% in Hawaii to 11% in Maryland. (Kaiser Health News, which produces California Healthline, is not affiliated with Kaiser Permanente.)

Lee downplayed the notion of a financial boon for California health plans, saying that, partly because of the use of telehealth, primary care has rebounded and the plans are paying for it. “So we don’t see this as being at this point a bonanza year for health plans,” he said. “Rather, it’s a year in which there are lessons learned for how we can deliver care in a pandemic.”

Still, the health plans are in a far stronger position than they had feared earlier this year.

In March, Covered California released a study showing that COVID-19’s impact on 2021 premiums for individuals and employers could range from an increase of 4% to more than 40%. But less than three months later, projections commissioned by the industry’s national advocacy group, America’s Health Insurance Plans, showed that even in the worst-case scenario of a 60% COVID infection rate — far above where it stands now — the pandemic would increase medical costs in 2020 and 2021 by 6% at most, and could even decrease them.

That moderate effect is largely attributable to what Katherine Hempstead, a senior policy adviser at the Robert Wood Johnson Foundation, called “a kind of yin and yang: If you have a lot of COVID, you don’t have a lot of other health care spending.”

Independent of the course the pandemic takes, emergency room and outpatient visits still lag behind pre-COVID levels and will probably continue to do so next year, to the continued benefit of insurers, predicted Glenn Melnick, a professor of health care finance at the University of Southern California’s Sol Price School of Public Policy. That could be good news for consumers, he said, potentially leading to lower premium increases or even reductions next year.

On the other hand, hospitals and doctors have lost money, and the ones whose contracts with health plans are up for renewal will be looking to make up those losses, Melnick said.

“Providers could be asking for 20-25% increases next year,” he said, “and if they’ve got market power, they can make it stick.”

July 31, 2020

From late March into April, Timothy Regan had severe coughing fits several times a day that often left him out of breath. He had a periodic low-grade fever, too.

Wondering if he had COVID-19, Regan called a nurse hotline run by Denver Health, a large public health system in his city. A nurse listened to him describe his symptoms and told him to immediately go to the hospital system’s urgent care facility..........................Read more

The coronavirus stimulus package Congress rushed out last week to help the nation’s hospitals and health care networks hands the industry billions of dollars in windfall subsidies and other spending that has little to do with defeating the COVID-19 pandemic.

The $2 trillion legislation, which President Donald Trump signed Friday, includes more than $100 billion in emergency funds to compensate hospitals and other health care providers for lost revenue and other costs associated with COVID-19. The measure also calls for spending up to $16 billion to replenish the nation’s depleted stockpile of medical gear, such as ventilators, medicines and personal protective equipment, or PPE.

But health care businesses will get billions of dollars in additional funding not directly related to the pandemic, in some cases because Congress agreed to reverse scheduled cuts in the rates paid by Medicaid and Medicare, which the federal government had tried for years to impose.

“Anything that could tangentially be related to the crisis lobbyists tried to get stuffed in this bill ― particularly health-care-related items,” said Steve Ellis, vice president of Taxpayers for Common Sense, a nonpartisan watchdog group. While the stimulus package is “not as big” a “Christmas tree” as some other bills, Ellis said, “I’m sure we’ll find a few baubles and gifts along the way.”

Hospitals have won widespread praise as their doctors and other medical staffs labor under perilous conditions, including shortages of protective gear. And, perhaps not surprisingly, the industry emerged as a big winner in the stimulus negotiations. Not only can hospitals draw on the $100 billion fund to stem their losses and cover other costs, but they will also see a boost in one stream of revenue as Congress overturned some planned rate cuts.

More than 3,000 hospitals that treat outsize numbers of Medicaid or uninsured patients, for instance, will share in an $8 billion windfall through the stimulus provision that reverses cuts in their Medicaid payments for 2020 and 2021.

Separately, hospitals will rake in at least $3 billion more because of a temporary suspension of a 2% cut in Medicare fees, according to the Federation of American Hospitals, which represents more than 1,000 for-profit hospitals and health systems. The infusion of cash also benefits doctors, nursing homes, home health companies and others.

“That’s welcome news during this time of crisis,” said Joanne Cunningham, executive director of the Partnership for Quality Home Healthcare.

Also tucked into the stimulus: a rollback of planned rate cuts to clinical laboratories and some medical equipment suppliers.

At this stage, it is unclear how much these measures will add to the COVID-19 tab ― or if far more stimulus would be required for the health care industry to rebound.

Take the 2% rate cut known as “the sequester.” The Office of Management and Budget expected it would save Medicare $16.2 billion in fiscal 2021. But the stimulus bill rescinds that rate cut from May 1 through the end of this year. As part of the legislation, Congress said it would, in effect, recoup the payments later by adding another year to the sequester. Whether lawmakers will follow through on that is anyone’s guess.

Anders Gilberg, senior vice president of government affairs for the Medical Group Management Association (MGMA), expects the sequester relief to translate to a “huge” financial boost for more than 15,000 medical practices his group represents.

“This would never have been done under any other circumstances,” Gilberg said. “The situation was recognized as dire.”

Dr. Patrice Harris, president of the American Medical Association, said the stimulus offers “needed financial relief to hard-hit workers, health systems and physician practices. At this critical moment, physician practices need significant financial support to sustain themselves and continue to meet the health care needs of all Americans during this time.”

Similarly, American Hospital Association CEO Rick Pollack called the legislation “an important first step forward. But, he added, “more will need to be done to deal with the unprecedented challenge of this virus.”

In a nod to clinical laboratories, which have helped bail out the federal government’s early failure to supply enough COVID-19 tests, the stimulus delayed planned rate cuts in 2021 likely to amount to tens of millions of dollars in revenue. Medicare officials have been at odds with the lab industry for years over rates for lab tests.

While other health care interests praised the bill, the laboratory trade association said it comes up short.

Just before the Senate passed the stimulus bill Wednesday, American Clinical Laboratory Association President Julie Khani slammed Congress for not designating funding to support labs. She said labs were in “an untenable situation, absorbing growing, uncompensated costs for testing specimens with no assurance that they will be appropriately or fairly reimbursed for all the tests they are performing.”

She added a not-so-veiled threat, saying: “If Congress fails to designate essential emergency funding for clinical laboratories to support our efforts, labs will be soon be forced to make difficult decisions about whether they can keep building the [testing] capacity our nation needs.”

The lab association, in a statement to Kaiser Health News, said labs have absorbed “staggering” Medicare reimbursement cuts of as much as 30% for many common tests in recent years.

In public securities filings this year, lab giants Quest Diagnostics Inc. and Laboratory Corp of America Holdings, known as LabCorp, reported they expected rate cuts in 2020 totaling more than $150 million. LabCorp said it supported the views of the lab association. Quest did not respond to a request for comment.

While labs processing COVID-19 tests missed out on direct funding, they could be eligible for some of the $100 billion allocated for hospitals and other providers to cover their losses, congressional aides said.

And the stimulus measure states that even in the event a lab is out-of-network, health plans are expected to pay the price it sets — as long as the lab publishes that price online — or negotiate with the lab.

Given that laws in some states ban surprise billing in particular, this provision seems to favor the labs, said Katie Keith, a Georgetown University law professor and health policy expert. “No one just lets the provider set the price,” she said.

The lab association disputes that, saying that many health plans are expected to pay them less than the $51.50 government recommended for a COVID-19 test.

Just how the $100 billion in health care funding will be distributed and how much oversight will occur is another unknown.

Health and Human Services Secretary Alex Azar has the authority to decide how long the emergency provisions remain in effect. Tracking all that money will be a challenge as well.

Ellis, the taxpayer advocate, noted that no government agency “is ready to handle the rush of extra funding.” He said that the stimulus grants extra resources to inspector general offices to monitor spending.

“There will be waste, there will be abuse,” he said. “It’s about exposing and rooting it out.”

The HHS Office of Inspector General expects to receive $4 million to support this oversight, according to spokesman Donald White.

Some groups aren’t waiting to compete over the $100 billion. The MGMA sent a letter March 27 to Azar and the Centers for Medicare & Medicaid Services chief Seema Verma asking for more direct help. Gilberg noted that some medical practices, such as doctors who perform colonoscopies, have not been able to continue their work.

“Doctors and physician practices are having a lot of trouble right now,” Gilberg said. “They are literally shut down, and they are having financial troubles. Their operations have come to a full halt.”

KHN correspondents Rachana Pradhan and Emmarie Huetteman contributed to this report.

Medical debt is a widespread problem in the US. One in five working-age Americans have trouble paying their medical bills, according to a 2016 Kaiser Family Foundation/New York Times survey

RIP Medical Debt was founded in 2014 by two former debt collections executives, Craig Antico and Jerry Ashton.

During their decades in the debt-buying industry, Craig and Jerry had learned of thousands of Americans saddled with unpaid and un-payable medical debt and realized they were uniquely qualified to help these people in need.

They went on to create a unique way to forgive medical debt; they would use donations to buy large bundles of medical debt for a fraction of its price, like debt collectors do, and then forgive that debt with no tax consequences to donors or recipients. Reportedly the debt purchase price averages a penny on the dollar, so, wiping out $100 of medical debt would cost about $1

RIP Medical Debt, is a New York based 501(C)(3) which is focused on helping people who are suffering the crippling medical costs

exacerbated by our broken health care system. The results have been spectacular — Nearly $1.4 billion in medical debts have been eradicated so far, providing financial relief for over 650,000 individuals and families. The organization says it seeks to relieve medical debt for those most in need, meaning people who earn less than two times the federal poverty level, have debt that is 5% or more of their annual income or face insolvency, meaning their debts are greater than their assets.

Click here to find out more about RIP Medical debt. There is also an article in CNN about this topic.

There are many factors contributing to the costs of healthcare. Click tor read about what is happening in the debate to control surprise medical bills on Kaiser Health News. This story also ran on NPR.

One of the most frequent questions I get about Medicare is “Do I need to sign up for Medicare when I turn 65 if I have employer group coverage?” And the answer is: It depends…. on the size of the employer group and some other factors:

- Your cost for the coverage (including premium contribution and out of pocket expenses for deductibles, copays and your annual out of pocket maximum)

- If the employer plan benefits meet your needs (benefits, provider network)

- If your employer group is less than 20 employees, you should sign up for Medicare Part A and Part B when you are first eligible or face a lifetime late enrollment penalty. You have a 7-month Initial Enrollment Period:

- 3 months prior to your 65th birthday

- your birthday month

- 3 months after your birthday month

In this case, Medicare is the primary payer and your employer group coverage pays secondary based on the benefit plan.

If your employer group is more than 20 employees, and has medical and prescription drug coverage that is at least as good as Medicare, you may not need to sign up for Medicare Part B right away. However, you should review the benefits and cost of your employer plan compared to the benefits and cost of Medicare plus a Supplement or Medicare Advantage plan. In many cases, people save money by enrolling with Medicare.

There are several options for Medicare Advantage and Medicare Supplement plans available, and the key is determining which one will offer you the best coverage based on your healthcare needs, your lifestyle and your budget.

Medicare agents must be licensed in the state they sell products and must complete an annual certification and insurance company specific product training each year to assure they are qualified to help beneficiaries in making good choices.

If you need assistance with your Medicare decisions, please contact me at 206-569-5415 or by email at suderloy@gmail.com. I am a licensed and certified health insurance agent in WA State and represent multiple health insurance companies. I can help you with your decision and enrollment for the plan that best meets your needs.

If you missed open enrollment for Individuals and Families for a January 1 coverage start date, you still have time to get coverage in place for February 1st. Washington State has extended open enrollment to January 15th for those who missed the December 15th deadline. January 15th is the absolute deadline unless you qualify for a Special Enrollment Period. If you need help and advice, contact an expert - Call Loy at 206-569-5415 or email Loy@Sudergroup.com. Get the help you need!

.jpg?fit=crop&w=280&h=280&q=93)

.jpg?fit=crop&w=200&h=200&crop=faces)

- Copy.jpg?fit=crop&w=280&h=280&q=93)